Vision

Wren Investment Group seeks stabilized, value-adding apartment properties of 50+ units in size, located in stable sub-markets which are poised for growth. These properties are then aggressively repositioned to effect:

1. Revenue maximization through targeted capital improvement

2. Cost containment through the implementation of institutional asset & property management

Wren Investment Group strategically targets exits from dramatically appreciated assets timed to coincide with an optimal position in the local market cycle. Participation window averages five to seven years.

Acquisition Criteria

Garden Style and Mid-Rise Apartments. Net lease commercial properties are also considered.

Asset Class

A+ to C+

Location Quality

A+ to B

Property Size

50+ units; single asset or portfolios

1. All cash to seller

2. Loan assumption on a case-by-case basis

Property Vintage

1978+

Pricing

$1M to $20M+

Target Markets

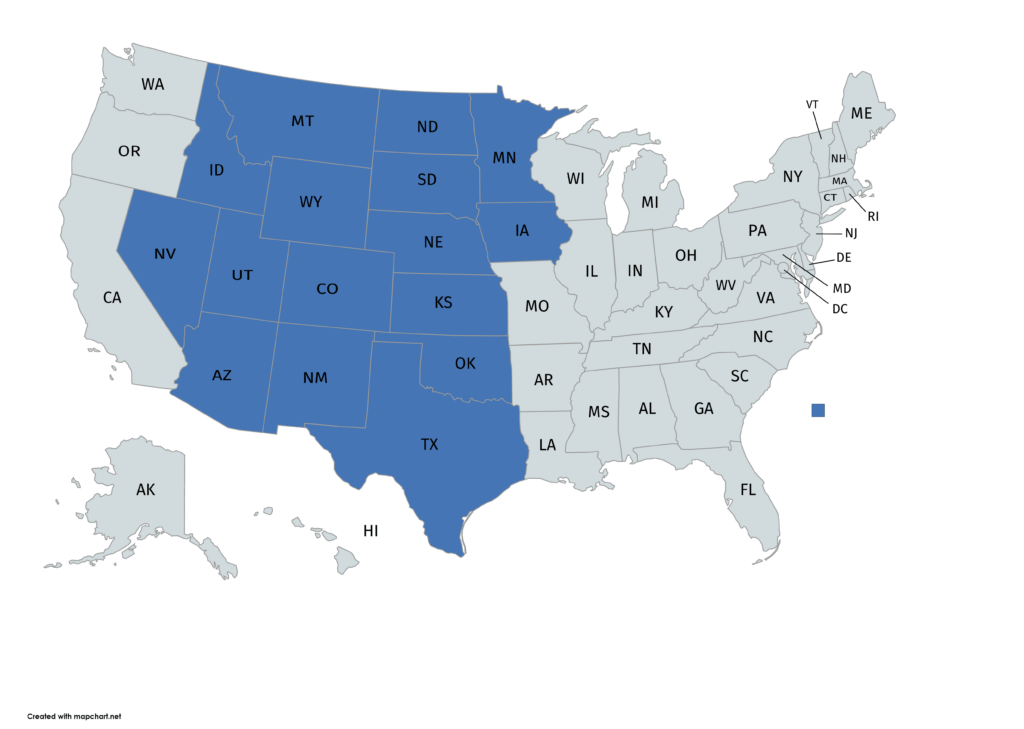

Throughout the Western and Mid United States with an emphasis on the below states: